Credit Rating in Transfer Pricing Analyses

Determining the credit quality of the borrower is a crucial step in preparing a reliable analysis to benchmark the arm's length interest rate for intercompany financial transactions. The arm's length principle requires that intercompany financial transactions are priced as they would be between independent parties under comparable circumstances. As stated in OECD Guideliness on Chapter X, independent lenders base interest rates on the borrower's creditworthiness, as it reflects the risk of default and the ability to repay the loan. By assessing the borrower's credit quality, the transfer pricing analysis ensures alignment with the arm's length principle.

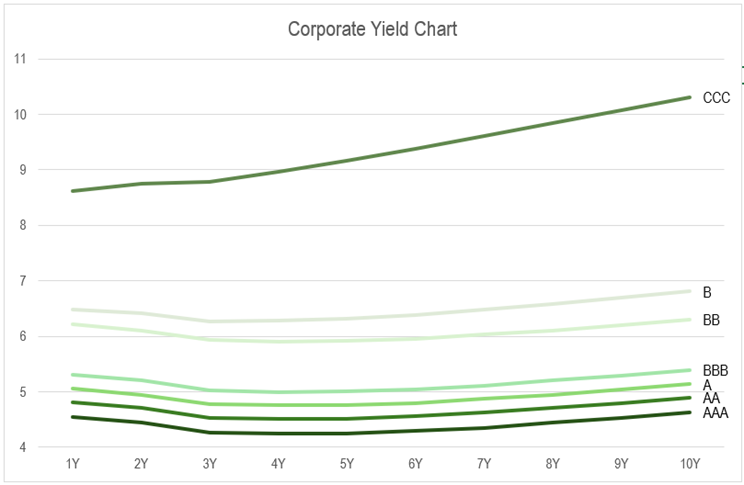

The impact of credit ratings on interest rates can be substantial. Interest rate spreads can vary significantly based on the issuer's credit rating. For example, the chart below shows the interquartile range (IQR) of Yield-to-Maturity for US$ denominated bonds as of November 26th, 2024.